By Adrian Lim

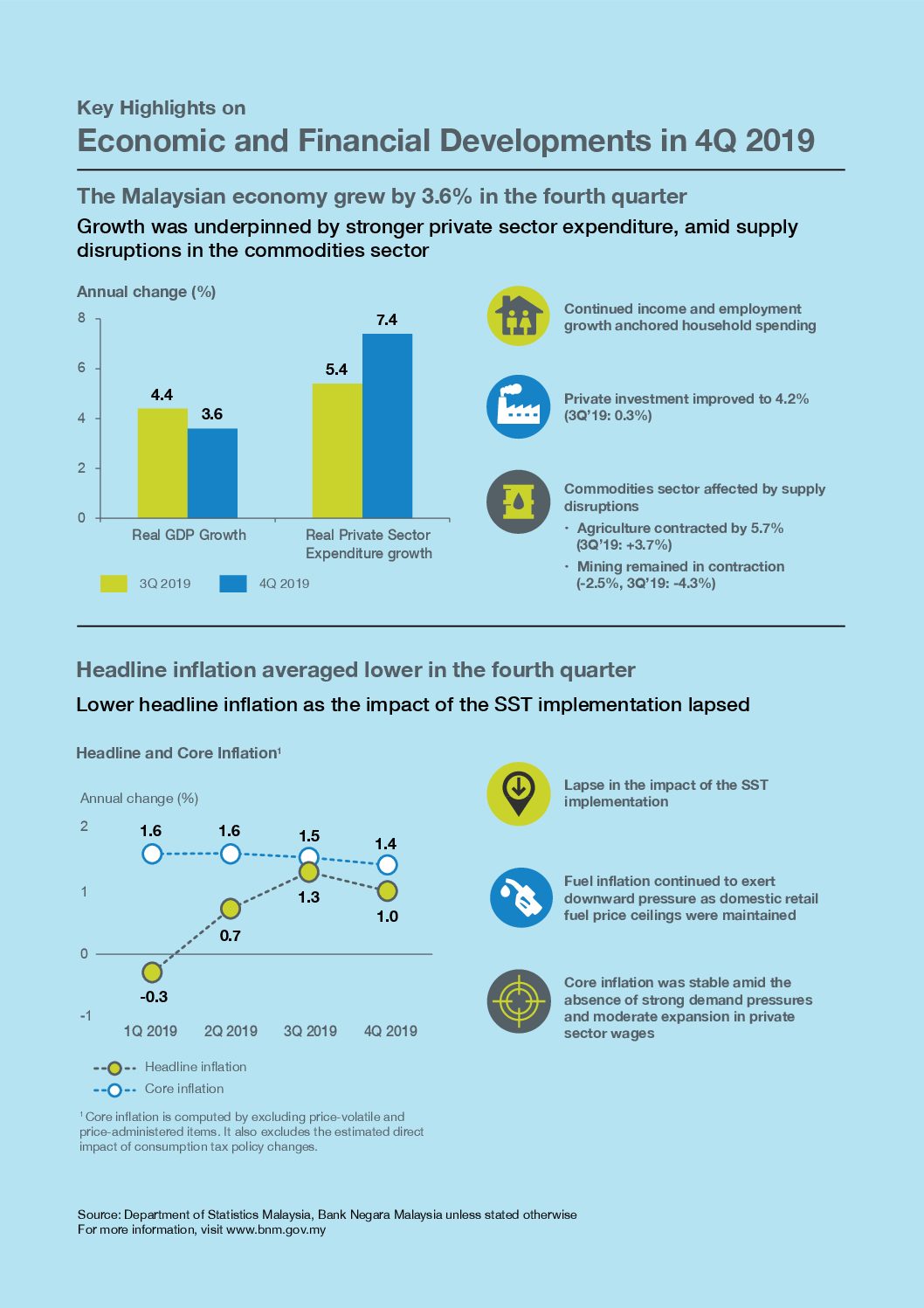

KUCHING, Feb 12: Malaysia’s economy growth moderated to 3.6 per cent in the fourth quarter of 2019 (4Q19) as compared to a growth of 4.4 per cent recorded in 3Q19 and 4.7 per cent registered in 4Q18.

Bank Negara Malaysia (BNM) in a statement today explained that the lower growth was caused by supply disruptions in the commodities sector.

As a result, the central bank noted that the Malaysian economy expanded by 3.6 per cent year-on-year (y-o-y) in 4Q19 as compared with a growth of 4.4 per cent y-o-y in 3Q18.

On a quarter-on-quarter (q-o-q) seasonally-adjusted basis, the central bank observed that the economy grew by 0.6 per cent as opposed to 0.9 per cent in 3Q19.

For 2019, BNM pointed out that the economy expanded by 4.3 per cent as compared with a growth of 4.7 per cent in 2018.

During 4Q19, the inflation rate averaged lower mainly reflecting the lapse in the impact from Sales and Services Tax (SST) implementation. Core inflation, excluding the impact of consumption tax policy changes, was stable at 1.4 per cent.

On another note, BNM revelaed the ringgit appreciated by 2.3 per cent against the US dollar in 4Q19, supported by the resumption in non-resident portfolio inflows.

The appreciation of the ringgit was due to improved investor sentiments following positive developments on global trade negotiations. Synchronised policy rate cuts by several major central banks also contributed to the improvement in global investor risk appetite during 4Q19.

As a result, in 2019, the ringgit recorded an appreciation of 1.1 per cent against the US dollar, in line with the trend of regional currencies.

The central bank predicted that the performance of the ringgit in 2020 will continue to be influenced by external developments.

Furthermore, it observed that while phase one of the trade deal between the US and China contributed to an improved outlook on global trade, investor sentiments could also be affected by concerns over the recent coronavirus outbreak.

As a result, BNM observed that the ringgit depreciated by 1.3 per cent against the US dollar this year up to February 10, amidst weaker sentiments in global financial markets.

Going into 2020, BNM forecasts that growth, particularly in the first quarter of the year, will be affected by the coronavirus outbreak.

It opined that the overall impact of the virus on the Malaysian economy will, however, depend on the duration and spread of the outbreak as well as policy responses by authorities.

For 2020, it opined that growth will be supported by household spending, the realisation of approved private investment projects in recent periods, and higher public sector capital spending.

Nevertheless, the central bank noted that there are downside risks to growth.

Those risks include uncertainties in external conditions arising from the ongoing coronavirus outbreak, the various trade negotiations and geopolitical risks, as well as domestic factors, including weakness in the commodities sector and delays in project implementation. — DayakDaily